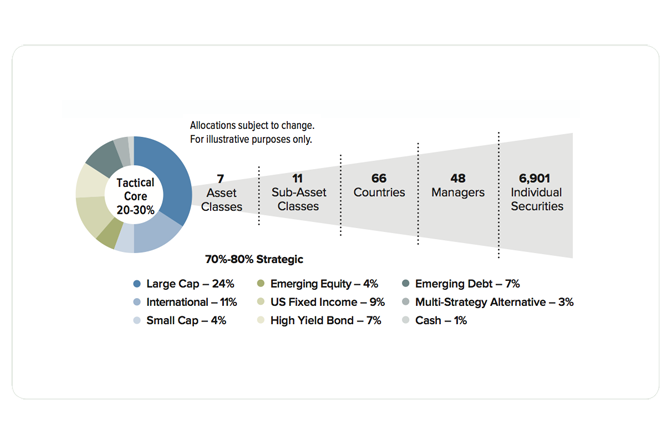

Portfolios consist of multiple layers of diversification designed to optimize return while managing risk. The number and variety of investment choices keep growing all the time. Each market and segment possesses different characteristics, return potential and risks.

Portfolio Construction: Multiple Layers of Diversification

Success requires diversifying the entire portfolio structure, using a five-level approach:

- The first level includes asset classes like equity and income-generating securities, such as bonds.

- The second level consists of multiple sub-asset classes and styles like large cap, small cap, growth and value.

- The third level demonstrates the geographic diversification of our portfolios. › The fourth level consists of individual managers, each of which is a specialist in a particular asset class or style.

- The fifth level represents the individual securities selected for each portfolio by those managers. Our operation continuously reviews the portion of each portfolio assigned to each independent investment manager.