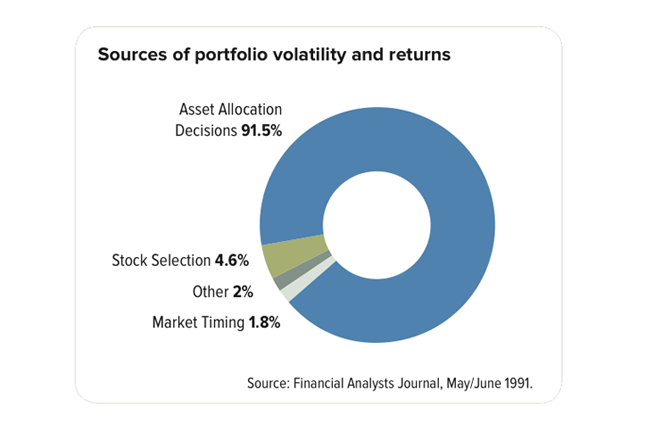

Contrary to what many individual investors believe, market timing and stock selection are not the keys to reaching investment goals. In fact, the most important step in the investment process is deciding how to allocate assets among broad asset classes such as stocks, bonds and cash alternatives.

Getting the asset mix right is essential. Research has shown that, over time, more than 90% of the differences between portfolios’ returns will come from the asset allocation. Careful asset allocation ensures that you’re invested in a diversified portfolio designed to help you progress toward your goals in various market environments.

The success of your investment plan begins by making sure your portfolio is right for your goals. As your advisor, we work with you closely to:

- Understand your goals and objectives

- Identify relevant risks

- Select the appropriate portfolios or allocations

Asset allocation is a unique process in which each of your objectives is carefully defined and aligned with multiple strategies that use various assets. - Allocations are actively managed over time as market conditions and asset-class characteristics change.

- Allocations are constructed using carefully selected components consistent with your strategy objectives.

- Ongoing research results in addition of new investment sub-classes to enhance opportunity.

The typical client portfolio will include a diversified mix of stocks, bonds and cash investments. The percentage devoted to each asset class will depend on your time horizon, risk tolerance and personal situation.